Furniture, clothes, mobile phones, jewellery – the value of your household contents is often higher than you think. Avoid underinsurance by choosing the right sum insured when you take out your household contents policy and adjusting your insurance on a regular basis.

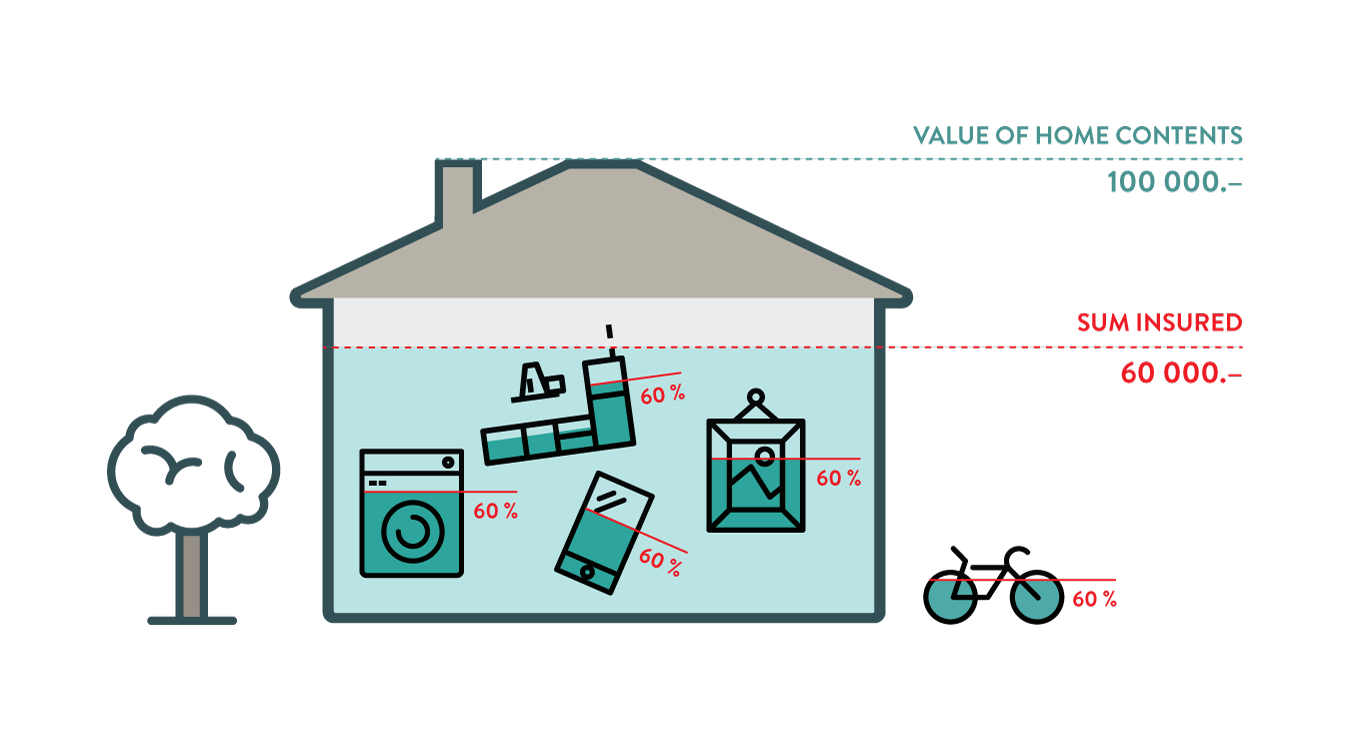

The sum insured is the replacement value of your entire household contents – in other words, the price you would pay if you had to buy new versions of all your possessions. If your chosen sum insured is lower than the effective value of your household contents, this is called underinsurance. In this situation, you would receive less in the event of a claim than the amount you need to replace your household contents.